Apr 8, 2022

In the realm of capital raising, the true north isn't marked by mere appointments or meetings, but rather by the tangible milestones of term sheets and signed sub-agreements. For General Partners (GPs) and executives immersed in the world of venture capital and private equity, optimizing time is paramount. Yet, all too often, the imperative focus on operational excellence and deal execution is diverted by the demanding task of fundraising.

However, raising capital need not be a time-consuming ordeal. The key to expediting this process lies in achieving what we call Investor-Message Fit.

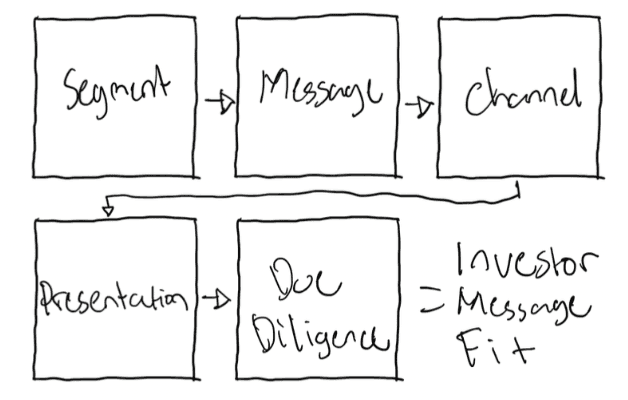

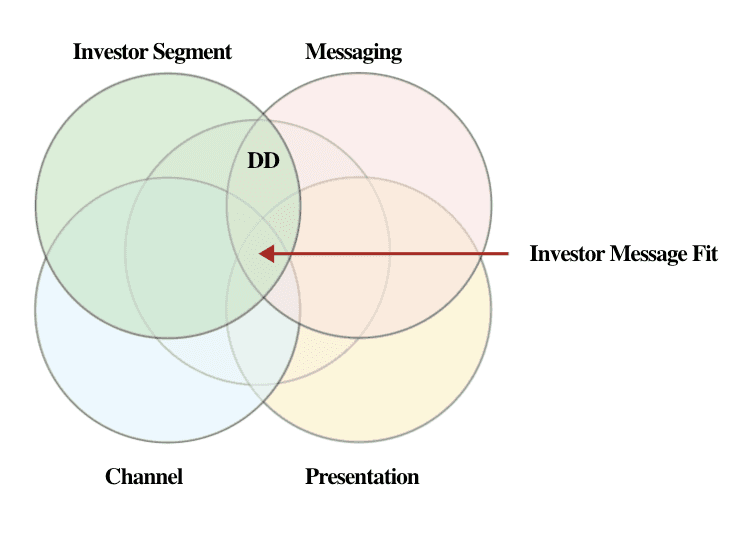

This elusive state is the confluence of several critical variables:

The investor segment (type),

The messaging (the persuasive language that compels them to engage),

The channel (the platform through which they are reached),

The presentation (the meeting itself), and

The due diligence process.

When Investor-Message Fit is attained, the calendar brims with meetings tailored to mandate-specific investors, multiple investor groups engage in due diligence concurrently, and funding requirements are met swiftly.

To reach this optimal state, each variable must be meticulously addressed in sequence. The pace at which this goal is achieved hinges on how rapidly these variables are navigated and aligned to hit the sweet spot.

The journey begins with crafting a hypothesis around the investor segment, delineating a clear profile of the sought-after investor. Subsequently, attention shifts to crafting a compelling message that not only grabs attention but also converts it into meaningful meetings. Deliberation follows on selecting the most effective channel to generate interest, coupled with iterative refinement of the presentation. Finally, meticulous attention is given to ensuring that the data room and due diligence materials are robust, providing seamless continuity with the presentation.

In essence, by methodically addressing each component of Investor-Message Fit, fund managers can significantly reduce the time and effort required to secure crucial capital commitments.

When each of these align you achieve IMF and term sheets begin hitting your inbox.

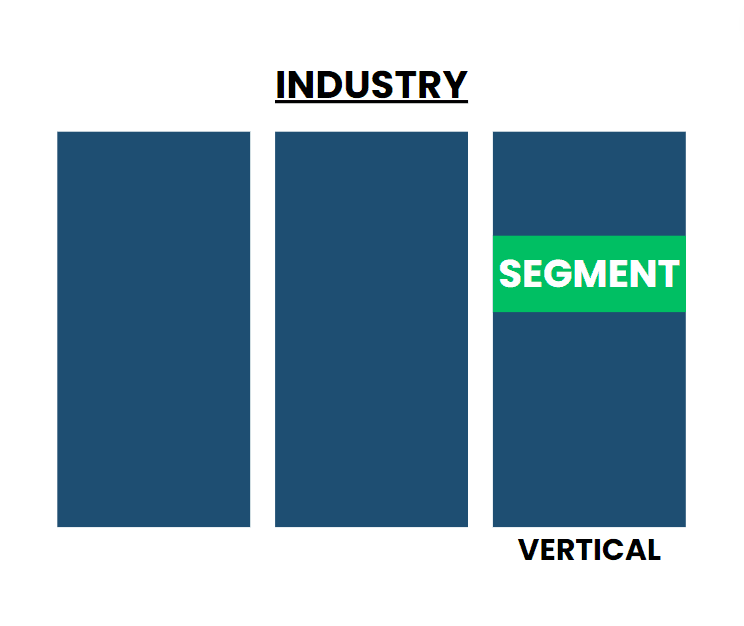

Step 1: Solving For Investor Segment

The initial stride towards achieving Investor-Message Fit involves meticulously addressing the investor segment. This entails identifying investor types that align seamlessly with your deal parameters, segmented based on various mandates such as industry, vertical, geographical location, stage of deal, EV requirements, raise amount, among others.

This curated mandate-specific investor list is your “Investor Segment”:

To facilitate this process, we have developed a comprehensive worksheet designed to guide you through the identification of investor types tailored to your specific requirements. This worksheet serves as a structured framework to pinpoint the precise investor categories that resonate with your investment thesis.

Solving For Investor Type | Matrix | Avalanche Capital

Upon completion of this worksheet, you will have assembled a curated list of mandate-specific investors, meticulously tailored to align with your deal parameters. This meticulously curated investor segment serves as the cornerstone of your capital-raising efforts, providing a targeted pool of potential investors primed for engagement.

Moving forward, the focus intensifies as you delve deeper into the granular realm of identifying specific firms and individuals within this investor segment. This strategic approach ensures that your outreach efforts are precisely targeted, maximizing the likelihood of securing meaningful investor commitments.

In the realm of Limited Partner (LP) considerations, several critical variables come into play when evaluating low/mid-market funds they would be looking to deploy capital towards:

Fund Strategy: The investment strategy of the fund (e.g., venture capital, private equity, debt, growth, buyout, etc.).

Track Record: Historical performance data of the fund or its management team.

Management Team: Experience and success record of the fund managers.

Fund Size: The total amount of capital the fund is looking to raise.

Investment Focus: Specific industries, geographies, or stages of investment the fund targets.

Fee Structure: Management fees and carried interest percentages.

Limited Partner Base: Types of investors the fund is targeting (e.g., institutional investors, family offices, high-net-worth individuals).

Minimum Investment: The minimum capital commitment required from investors.

Fund Term: The life span of the fund.

Portfolio Composition: The diversity and balance of investments within the fund's portfolio.

Risk Profile: The level of risk associated with the fund's investment strategy.

Provisions: Terms regarding the liquidity of the investment or lock-up periods.

This is the most time consuming part of the process, as you will need to research each of your targets, their mandates, EV requirements, Sector Focus, Equity Check Size, Minimum EBITDA, etc.

Here are some conventional ways of creating a targeted list:

Conventional Method 1: Introductions & Personal Networks

Leveraging introductions and personal networks remains a valuable method for reaching investors, particularly when complemented by other approaches. This may involve attending networking events, leveraging social media for inbound leads, and tapping into existing connections.

A 2019 survey conducted by the British Business Bank revealed that in London, referrals account for almost 60% of the total deal flow and that referred companies have a 50% better chance of receiving investment.

Drawbacks:

→ Reliance on personal networks necessitates having an extensive network to facilitate introductions swiftly.

→ Even with an established network, achieving perfect alignment with potential investors can be challenging, and the process is inherently time-consuming.

→ Few deals are produced by founders who beat a path to a VC’s door without any connection. Some of the VC executives HBR interviewed acknowledged the downsides of this reality: that the need to be plugged into certain networks can disadvantage entrepreneurs that don't come from the right background.

Conventional Method 2: Manual Search

Engaging in manual searches via platforms like LinkedIn, Google, and other search engines is a conventional method for pinpointing potential investors.

Drawbacks:

→ This approach is time-consuming, particularly when striving to expedite the process toward securing term sheets or signed agreements.

→ Additionally, accessing pertinent information through these databases can prove challenging.

Conventional Method 3: Basic Databases

Utilizing basic databases such as Sales Navigator, Crunchbase, and others offers a step above manual searches. While these platforms provide access to a pool of existing investors, there are drawbacks.

Drawbacks:

→ Often, mandate information is outdated, rendering search parameters less effective.

→ Moreover, contact details may not always be accurate, and the widespread accessibility of these databases results in heightened competition for investor attention, diminishing success rates.

1.1 Innovative Way To Curate Your Target List & Conduct Research Simultaneously

Enterprise Databases offer an innovative and efficient approach to segmenting your investor list and identifying mandate-specific targets that align with your deal criteria in record time. Leveraging these platforms allows you to streamline the research process and gather comprehensive information within minutes.

Here are the top enterprise databases for this purpose:

Bloomberg Terminal, Thomson Reuters Eikon, Pitchbook, Capital IQ, Preqin, Dow Jones Factiva, FamilyOffices

Utilizing these platforms enables you to extract essential data such as first and last names, email addresses, phone numbers, firm names, locations, bios, LinkedIn profiles, Twitter handles, and website URLs.

→ It's important to note that these are enterprise-level software solutions, meaning they come with enterprise-level pricing. However, the investment is justified by the unparalleled efficiency and accuracy they offer in curating your target list.

→ Regardless of your sector, industry, vertical, or deal type, these databases provide access to a comprehensive pool of current mandate-specific investors. They are the same tools utilized by bulge bracket investment banks to transcend network limitations and by PE/VC firms to streamline their capital-raising efforts.

1.2 Personalization

After compiling your target list, the next crucial step is crafting personalized messages for each contact. This tailored approach demonstrates diligence and significantly enhances the probability of securing meetings with your targets.

Personalization prompts include:

Reference a Recent Event: Acknowledge any recent industry developments or events relevant to the contact's interests or activities.

Personalize with Specific Details: Incorporate specific details about the contact's background, interests, or professional achievements to demonstrate genuine interest and understanding.

Highlight a Recent Allocation: Draw attention to a recent investment or allocation made by the contact, especially if it complements your offering or investment thesis.

Highlight Mutual Connections: Reference any mutual connections or shared experiences to establish rapport and credibility.

Express Genuine Admiration: Convey authentic admiration or appreciation for the contact's work, achievements, or contributions in their field.

By integrating these personalization prompts into your outreach strategy, you can effectively differentiate your communications and foster meaningful connections with your target investors.

Step 2: Solving For Messaging

In modern investor outreach, efficient and high-level communication methods are paramount. Step 2 focuses on leveraging contemporary approaches to messaging, ensuring effectiveness and expediency.

2.1 Creating Your Foundational Teaser Document

The foundational teaser document serves as the bedrock of your messaging strategy, providing a succinct overview of your fund's investment thesis and strategy.

Components of the foundational teaser document tailored for VC fund raising include:

Executive Summary

Investment Strategy

Market Opportunity

Fund Performance (if applicable)

Track Record of Fund Managers

Fund Size and Structure

Investment Focus and Thesis

Team Expertise and Experience

Investment Opportunity and Terms

Additional Information

2.2 Assemble Your Deck

Utilize a proven deck format that resonates with LPs, effectively conveying the value proposition of your fund and investment opportunity.

Slide Structure:

Fund Overview: Introduction to the fund's mission and investment focus.

Investment Strategy: Explanation of the fund's investment approach and thesis.

Market Opportunity: Analysis of market trends and opportunities targeted by the fund.

Fund Performance (if applicable): Highlighting past performance and track record.

Team Expertise: Showcase of the fund managers' experience and qualifications.

Fund Structure: Details on fund size, structure, and terms of investment.

Investment Portfolio: Showcase of current investments or potential opportunities.

Exit Strategy: Explanation of the fund's exit strategy and potential returns.

Track Record: Demonstrating successful past investments and exits.

Fundraising Goals: Outline of fundraising goals and timeline.

Investor Benefits: Explanation of the benefits of investing in the fund.

Next Steps: Call to action for potential LPs to engage with the fund.

Additional Details:

Market research, competitive analysis, and fund-specific details can be included in the appendix for reference.

Deck Builders:

Here are some additional resources you can use:

33 Legendary Startup Pitch Decks and What You Can Learn From Them [+10 Free Templates]

You can do a basic search for decks if you're in Real Estate or have a fund.

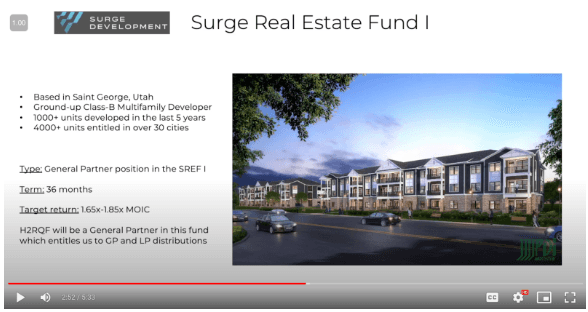

2.3 Creating A Video Investor Presentation

(See Example)

Using a software like loom.com, record a video presentation of you going over your deck. You can make this between 7-12 minutes long, focus on your background and track record along with the investment opportunity.

2.3 Creating Your Demand Generation Machine

To create your email template you're going to feed ChatGPT your teaser document and ask it to create an email to LPs using the information in the teaser.

Here is the proven format we use:

—-

Hello {{firstname}),

{{personalization}}

1-2 sentence overview highlighting the company and unique selling proposition. (Think thesis, strategy, opportunity, how it's different)

Key Highlights:

Break your highlights down into bullet points

Executive Summary

Investment Strategy

Market Opportunity

Fund Performance (if applicable)

Track Record of Fund Managers

Fund Size and Structure

Investment Focus and Thesis

Team Expertise and Experience

Investment Opportunity and Terms

Additional Information

1-2 sentences on Funding Requirements

Call to action

Sign off,

—-

Keep playing with your prompt in GPT till you get something you like, then copy and paste it into a google doc to make your final touches.

You want to ensure you don't use any hyperbolic or verbose language, keep it direct and to the point.

2.4 Creating Your DM Template

Run your finished email template through GPT to come up with a punchy 300 character message that can be used for social DMs.

Example:

—-

Hey {{firstname}},

Would you be interested in a passive real estate investment with a target ROI of 15-17% IRR paid out in monthly distributions? Shoot me a message if you would like to learn more or schedule a very brief call.

Thanks

—-

Step 3: Solving For Channel

The channel through which your messaging is conveyed to your target list of investors plays a critical role in generating attention and ultimately securing investor presentation meetings.

Conventional Method 1: Manual Outreach

Manual outreach involves individually crafting and sending emails or messages to your target list. While personalized, this approach is time-consuming and lacks scalability.

Conventional Method 2: Warm Intros

Warm introductions, conducted over the phone or in person, rely on connections within your existing network. While targeted, this method is difficult to scale and requires a substantial network to identify a robust target list.

Innovative Method 1: Automated Outreach

Automated Email:

Leveraging email automation streamlines the process of generating interest among your target list. By front-loading the work and managing the inbox, you can efficiently engage with potential investors. Note: Avoid including links or attachments in automated emails.

Ideal Investor Segments: Institutional

How to Run Cold Email

Linkedin Automation:

Supplementing email outreach efforts with automation tools on LinkedIn can enhance engagement and provide an additional touchpoint with potential investors. This approach allows for the attachment of decks and links, expanding the scope of communication beyond traditional email channels.

LinkedIn automation is particularly effective for reaching accredited retail investors, especially in offerings such as early-stage ventures or real estate funds that may not provide an annualized rate of return.

Ideal Investor Segments:

Institutional investors

Angels/High Net Worth individuals

Accredited retail investors

LinkedIn Automation SOP

Step 4: Solving For Presentation

The presentation serves as the linchpin of the fundraising process, wielding significant influence over the outcome of a deal. While alignment with investor mandates is crucial, particularly in the low to mid-market space, the presentation's impact transcends mere alignment—it is a reflection of your team's competence and capabilities.

How do you get investors to buy you? Hierarchical Dynamics.

Positioning Hierarchical Dynamics, and Investor Relations

The Conventional Presentation Process:

Traditionally, pitching to investors occurs via video calls or in-person meetings, with the outcome often hinging not only on the merits of the deal but also on the presenter's salesmanship. Response to the presentation determines whether it progresses to due diligence, underscoring the importance of effective communication and persuasion skills.

The Innovative Way To Develop Your Pitch:

Engaging a seasoned professional with expertise in Investment Banking, Venture Capital, or capital markets to assist in developing your pitch offers a strategic advantage, ensuring it presents a compelling, linear argument grounded in real-world experience.

By leveraging their expertise, you can streamline the presentation development process and accelerate progress towards securing term sheets or signed agreements. Additionally, incorporating feedback and insights gathered from meetings into subsequent presentations fosters a constructive feedback loop, continually improving the relevance and effectiveness of your pitch.

The Iteration Process:

Harnessing questions and addressing sticking points raised during meetings is integral to refining your presentation iteratively. By incorporating feedback from investor interactions into subsequent presentations, you establish a constructive feedback loop that drives continuous improvement in the relevance and depth of your pitch.

Each encounter offers valuable insights into investor perspectives, concerns, and areas of interest. By actively listening to feedback and adapting your presentation accordingly, you can tailor your message to resonate more effectively with your audience. This iterative approach not only enhances the clarity and persuasiveness of your pitch but also demonstrates your receptiveness to feedback and commitment to delivering a compelling investment opportunity.

The Pre-Pitch:

Utilize your Video Investor Presentation as a strategic asset to engage and inform potential investors prior to direct communication. This approach lays the groundwork for subsequent discussions, facilitating a streamlined process from initial contact to the issuance of term sheets. Moreover, it aids in establishing your Hierarchical Dynamic, positioning your team as knowledgeable and authoritative in the eyes of investors.

Warm Intros

During your presentation, strategically request introductions to additional investors who may be interested in the opportunity. Aim to make this appeal towards the conclusion of your discourse, expanding your network and potential investment avenues. By leveraging warm introductions, you can capitalize on existing relationships to access a broader pool of potential investors and enhance your fundraising efforts.

Video Trainings:

The 3 Magic Ingredients of Amazing Presentations | Phil WAKNELL | TEDxSaclay

The Secret to Successfully Pitching an Idea | The Way We Work, a TED series

Pitching to Corporate Investors

How to Stand Out to Sequoia with Mike Vernal (Sequoia Capital)

Step 5 - Solving For Investor Due Diligence

Investor Due Diligence (DD) represents a pivotal stage in the fundraising process, often consuming a significant amount of time. To optimize for speed and efficiency, it is imperative to have a comprehensive and well-organized data room established prior to the initial meeting with investors. A robust data room facilitates an expeditious review process and minimizes delays that may arise from incomplete or missing information.

Hold-ups during DD commonly occur when the data room lacks completeness or essential information is missing. Therefore, meticulous attention to detail in curating and maintaining the data room is paramount. By proactively addressing potential gaps and ensuring all pertinent documentation is readily accessible, fund managers can streamline the DD process, instill investor confidence, and expedite the progression towards securing commitments and ultimately closing the deal.

Best Practices For Managing Due Diligence Hold-Ups in VC Fundraising

1. Ensure Data Room Completeness:

Maintain a comprehensive and well-organized data room with all relevant documents and information readily accessible.

Conduct regular reviews to ensure completeness and address any gaps or missing information proactively.

2. Address Legal and Compliance Checks:

Proactively resolve any legal issues or discrepancies in documentation to expedite the due diligence process.

Maintain transparency and provide clear explanations for legal and compliance matters to facilitate LP understanding.

3. Provide Accurate Financial Analysis:

Ensure accuracy and consistency in financial data and projections provided to LPs.

Address any discrepancies or inconsistencies in financial information promptly and transparently.

4. Enhance Operational Due Diligence:

Showcase strong governance structures, management team capabilities, and operational processes.

Be prepared to address LP inquiries regarding operational efficiency and risk management practices.

5. Optimize Investment Portfolio Review:

Highlight the quality and performance of the fund's existing investment portfolio.

Address any concerns or questions raised by LPs regarding portfolio diversification and alignment with investment strategy.

6. Stay Informed of Regulatory and Market Changes:

Monitor regulatory requirements and market trends that may impact the investment opportunity.

Provide updates to LPs regarding any changes and their potential implications for the investment.

Closing Stage SOPs

7. Promptly Respond to Follow-up Requests:

Address any follow-up requests from LPs promptly and provide comprehensive responses.

Ensure that all requested information is provided in a timely manner to avoid unnecessary delays.

8. Efficiently Navigate Terms Negotiation:

Engage in transparent and collaborative negotiations regarding investment terms with LPs.

Strive to find mutually beneficial solutions and compromises to expedite the negotiation process.

9. Facilitate Investor Committee Approval:

Provide all necessary documentation and information to facilitate LP investor committee approval.

Communicate effectively with LPs regarding the timeline and process for investor committee review.

I've created this checklist for VCS, RE, Debt & Funds:

Due Diligence Requirements | Avalanche Capital

Additional Resources:

SAMPLE VC DUE DILIGENCE REQUEST LIST

Fundraising Options For Low-To-Mid Market Funds

Summary

1. Solve for the investor segment

2. Solve for your messaging

3. Solve for the channel used to deliver the messaging

4. Solve for the investor presentation

5. Finally, ensure you investor DD is robust

These are the concise steps necessary to raising capital for founders, execs and GPs in any market condition.